OVERVIEW

What is Private Placement Life Insurance?

Private Placement Life Insurance (PPLI) is a sophisticated financial tool that empowers high-net-worth individuals to optimize their wealth, minimize taxes, and secure their legacies. Explore the transformative benefits of this exclusive insurance solution.

A powerful wealth management tool for high-net-worth individuals consisting of a specialized form of variable universal life insurance (VUL).

Policyholder’s premiums can be invested in a variety of investment options and asset classes.

A tax-advantaged vehicle for tax-inefficient investments.

Offers the same tax treatment as traditional life insurance policies.

Why Choose Private Placement Life Insurance?

PPLIs are customized for each policyholder, with investments held in a separate account managed by the insurance carrier. This allows tailoring to specific investment goals and strategies.

Investment Flexibility

PPLI allows policyholders to invest in a wide range of alternative assets, including hedge funds, private equity, and real estate, without incurring immediate tax liabilities. This tax-deferred growth accelerates wealth accumulation over time.

Compounding Gains

By deferring taxes, the policyholder's investments can compound at a higher rate, leading to exponential growth in the policy's cash value. This powerful effect amplifies the long-term returns on the investment portfolio.

Tax Efficiency

PPLI's tax-deferred structure enables policyholders to optimize their overall tax liability, as they can access the policy's cash value through low-interest loans rather than taxable withdrawals or surrenders.

Combines Asset Management, Life Insurance, and Policy Management

An advanced wealth planning solution that combines asset management, life insurance, and policy administration within a Private Placement Life Insurance structure. It provides affluent individuals and families with tax-efficient investment growth, flexible policy design, and streamlined management of both assets and insurance coverage, all in one integrated framework.

Asset Management

Our 3 Pay Solution includes comprehensive asset management services, ensuring your investments are strategically allocated and managed to maximize long-term growth.

Life Insurance

Integrated life insurance coverage provides financial protection for your loved ones, giving you the peace of mind that your family is cared for.

Policy Management

Our policy management services simplify the complexities of financial planning, allowing you to easily manage and monitor your policies and accounts.

Holistic Approach

By combining these essential financial elements, our 3 Pay Solution offers a truly holistic approach to financial planning and security.

HOW IT WORKS

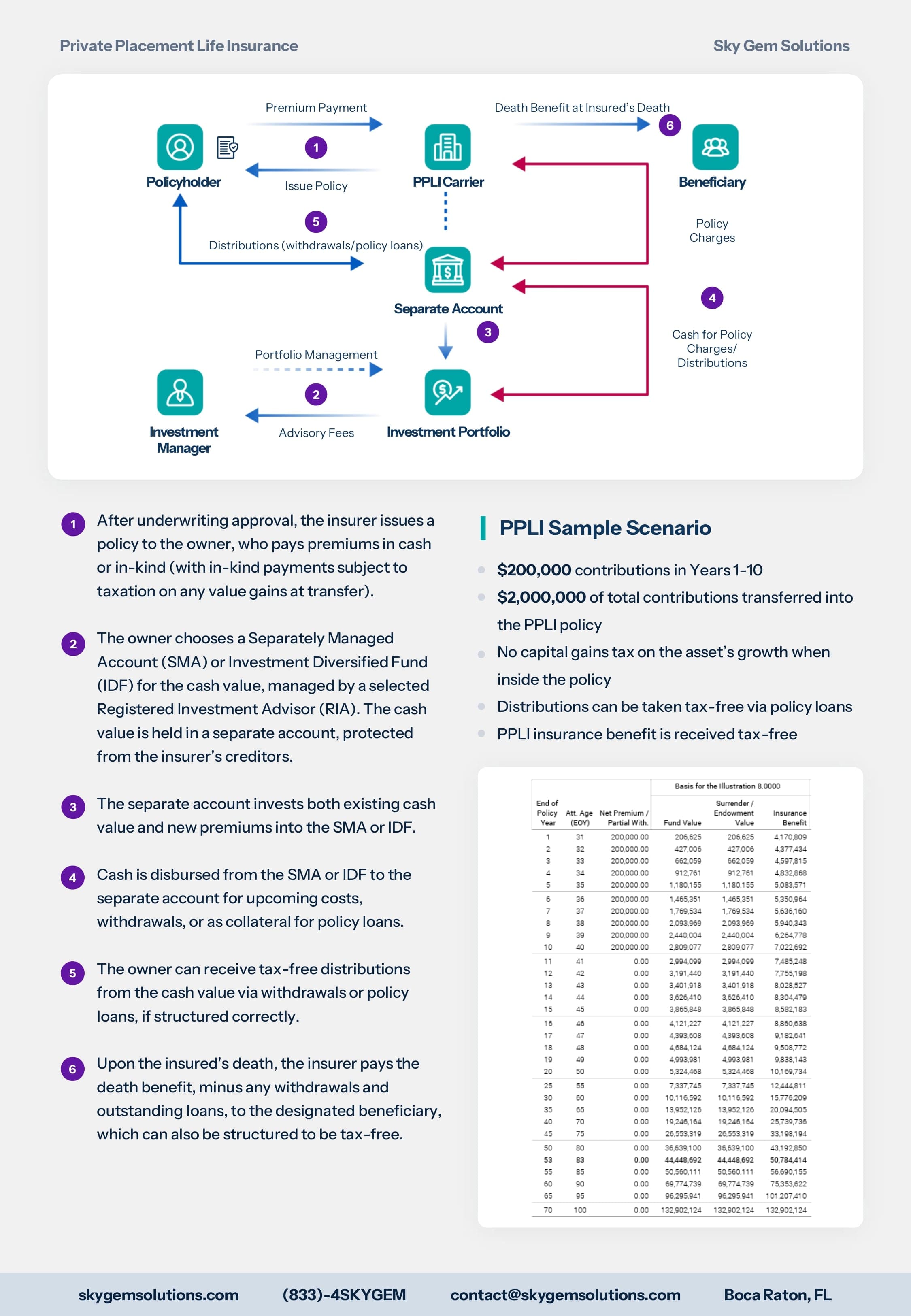

The Private Placement Life Insurance Structure

Private Placement Life Insurance (PPLI) works by allowing a high-net-worth individual to allocate assets into a specialized life insurance policy that combines long-term investing with significant tax advantages. Rather than focusing on how premiums are financed, PPLI emphasizes tax-deferred investment growth within a life insurance structure, providing an efficient way to build, protect, and transfer wealth.

01

Policy Issuance and Premium Payment

After underwriting approval, the insurer issues a policy to the owner, who pays premiums in cash or in-kind (with in-kind payments subject to taxation on any value gains at transfer).

02

Investment Selection and Asset Protection

The owner chooses a Separately Managed Account (SMA) or Investment Diversified Fund (IDF) for the cash value, managed by a selected Registered Investment Advisor (RIA). The cash value is held in a separate account, protected from the insurer's creditors.

03

Investment Allocation

The separate account invests both existing cash value and new premiums into the SMA or IDF.

04

Cash Disbursement Management

Cash is disbursed from the SMA or IDF to the separate account for upcoming costs, withdrawals, or as collateral for policy loans.

05

Tax-Free Distribution Access

The owner can receive tax-free distributions from the cash value via withdrawals or policy loans, if structured correctly.

06

Death Benefit Payout

Upon the insured's death, the insurer pays the death benefit, minus any withdrawals and outstanding loans, to the designated beneficiary, which can also be structured to be tax-free.

PPLI: Cost-Benefit

Costs

Premiums on domestic policy (or loan interest, if financed)

PPLI insurance charges (between 0.25-0.55% annually on fund value)

Benefits

No income tax on distributions

No capital gains tax on assets' growth

PPLI assets + insurance benefit are received tax-free

IS IT RIGHT FOR YOU?

Ideal Client Profile

Premium financing is designed for high-income and high-net-worth individuals seeking specific financial goals.

Requirements

Net worth of $5M or more

Accredited or qualified investor status

Desire for sophisticated, tax-efficient investment strategies

Those with a sizeable percentage of wealth in invested assets

Comfort with customized, actively managed portfolios

Financial Objectives

Achieve tax-deferred and tax-free investment growth

Access institutional and alternative investments in a tax-efficient wrapper

Enhance estate and legacy planning outcomes

Reduce income and estate tax drag on high-growth assets

Create flexible, tax-efficient wealth transfer strategies

Learn

Private Placement Life Insurance Overview

Download or view our comprehensive private placement life insurance overview document.